Info-paedia : RBI Report on Banking Trends in India

Why in News?

- Recently the Reserve Bank of India (RBI) released a report on the

trend and progress of banking in India in 2021-22.

Key Highlights:

- The Report is a statutory publication in compliance with Banking

Regulation Act, 1949.

- Observations of the report-

- Consolidated balance sheet of Scheduled Commercial Banks (SCBs)

registered double digit growth in 2021-22.

- By March-2022, the gross non-performing asset (GNPA) ratio

for all SCBs has improved to 5.8% from 7.3% in 2020-21.

- Overall reduction in GNPAs for all bank groups, except foreign

banks, during 2021-22.

- Financial performance parameters such as capital buffers,

Capital-to-risk weighted Asset Ratio, Slippage Ratio etc. showed

improvement.

- Reasons for declining NPA-

- Reduced Share of large borrowings.

- Loan write-off by public sector banks.

- Upgradation of loans in private banks.

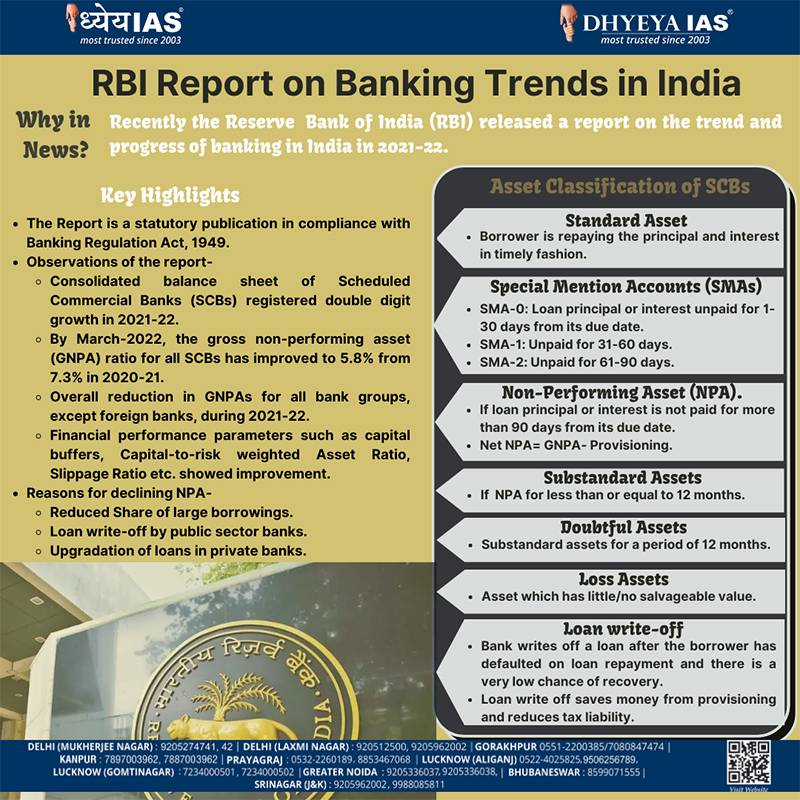

Asset Classification of SCBs

- Standard Asset

- Borrower is repaying the principal and interest in timely fashion.

- Special Mention Accounts (SMAs)

- SMA-0: Loan principal or interest unpaid for 1- 30 days from

its due date.

- SMA-1: Unpaid for 31-60 days.

- SMA-2: Unpaid for 61-90 days.

- Non-Performing Asset (NPA).

- If loan principal or interest is not paid for more than 90 days from

its due date.

- Net NPA= GNPA- Provisioning.

- Substandard Assets

- If NPA for less than or equal to 12 months.

- Doubtful Assets

- Substandard assets for a period of 12 months.

- Loss Assets

- Asset which has little/no salvageable value.

- Loan write-off

- Bank writes off a loan after the borrower has defaulted on loan

repayment and there is a very low chance of recovery.

- Loan write off saves money from provisioning and reduces tax

liability.