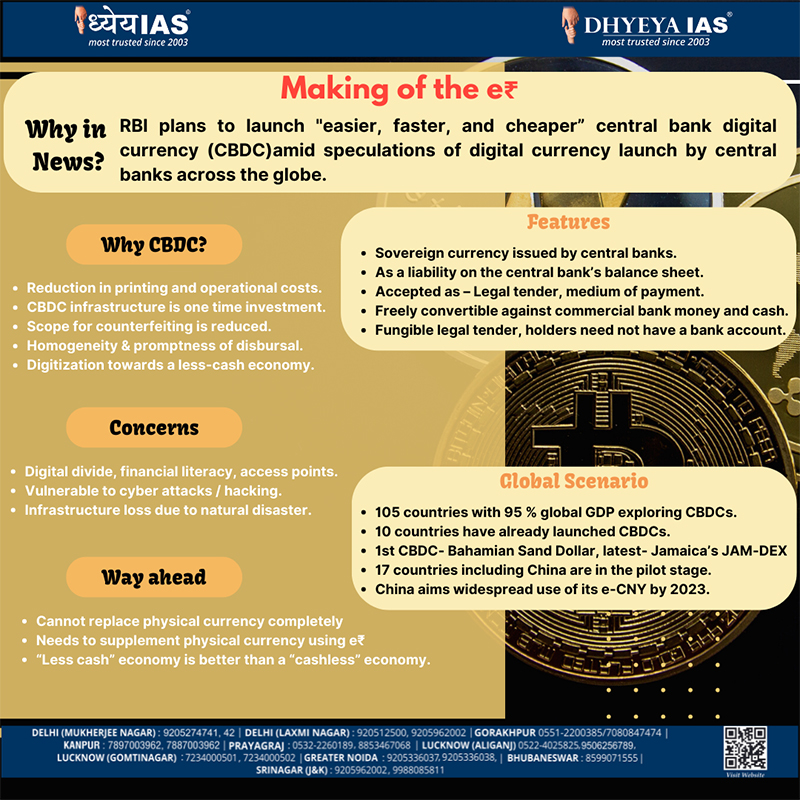

Why tin News?

- RBI plans to launch "easier, faster, and cheaper” central bank digital currency (CBDC)amid speculations of digital currency launch by central banks across the globe.

Why CBDC?

- Reduction in printing and operational costs. CBDC infrastructure is one time investment. Scope for counterfeiting is reduced.

- Homogeneity & promptness of disbursal. Digitization towards a less-cash economy.

Features

- Sovereign currency issued by central banks.

- As a liability on the central bank’s balance sheet. Accepted as – Legal tender, medium of payment.

- Freely convertible against commercial bank money and cash. Fungible legal tender, holders need not have a bank account.

Concerns

- Digital divide, financial literacy, access points. Vulnerable to cyber attacks / hacking.

- Infrastructure loss due to natural disaster.

Global Scenartio

- 105 countries with 95 % global GDP exploring CBDCs. 10 countries have already launched CBDCs.

- 1st CBDC- Bahamian Sand Dollar, latest- Jamaica’s JAM-DEX 17 countries including China are in the pilot stage.

- China aims widespread use of its e-CNY by 2023.

“Less cash” economy is better than a “cashless” economy.

Way ahead

- Cannot replace physical currency completely Needs to supplement physical currency using e₹