Info-paedia : Indias First Sovereign Green Bonds Framework

Why in News?

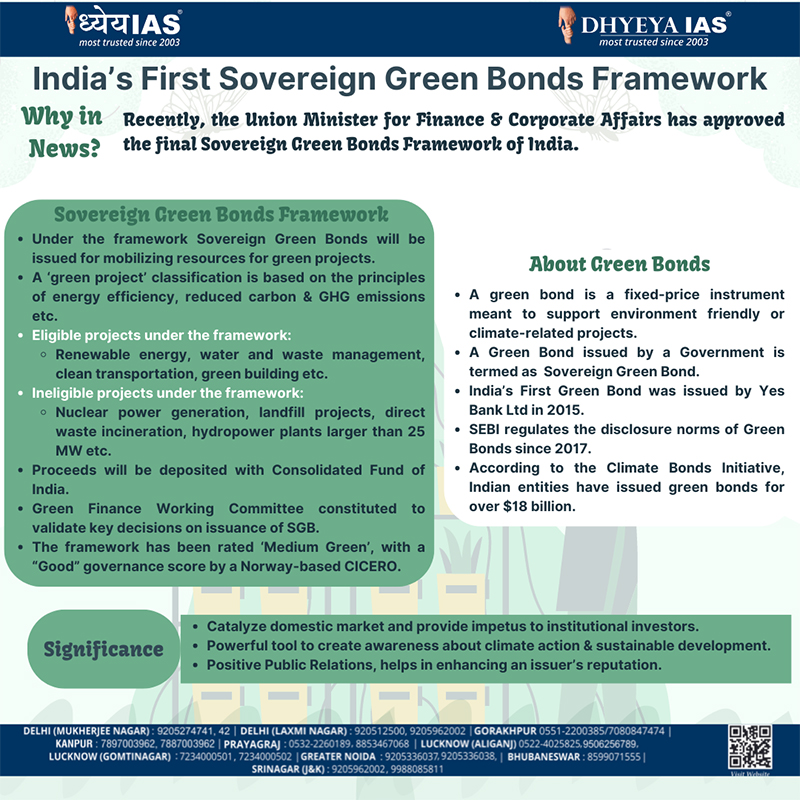

- Recently, the Union Minister for Finance & Corporate Affairs has

approved the final Sovereign Green Bonds Framework of India.

Sovereign Green Bonds Framework

- Under the framework Sovereign Green Bonds will be issued for mobilizing

resources for green projects.

- A ‘green project’ classification is based on the principles of energy

efficiency, reduced carbon & GHG emissions etc.

- Eligible projects under the framework:

- Renewable energy, water and waste management, clean transportation,

green building etc.

- Ineligible projects under the framework:

- Nuclear power generation, landfill projects, direct waste

incineration, hydropower plants larger than 25 MW etc.

- Proceeds will be deposited with Consolidated Fund of India.

- Green Finance Working Committee constituted to validate key decisions on

issuance of SGB.

- The framework has been rated ‘Medium Green’, with a “Good” governance

score by a Norway-based CICERO.

About Green Bonds

- A green bond is a fixed-price instrument meant to support environment

friendly or climate-related projects.

- A Green Bond issued by a Government is termed as Sovereign Green Bond.

- India’s First Green Bond was issued by Yes Bank Ltd in 2015.

- SEBI regulates the disclosure norms of Green Bonds since 2017.

- According to the Climate Bonds Initiative, Indian entities have issued

green bonds for over $18 billion.

Significance

- Catalyze domestic markets and provide impetus to institutional

investors.

- Powerful tool to create awareness about climate action & sustainable

development.

- Positive Public Relations, helps in enhancing an issuer’s reputation.